Want To Buy a Blue Corvette in 2025? Here’s How To Afford It

Understanding the Financial Commitment

Buying the 2023 Corvette Stingray requires a significant financial commitment. To navigate this investment wisely, it’s recommended to consider the following rules and strategies:

The 20/4/10 Rule

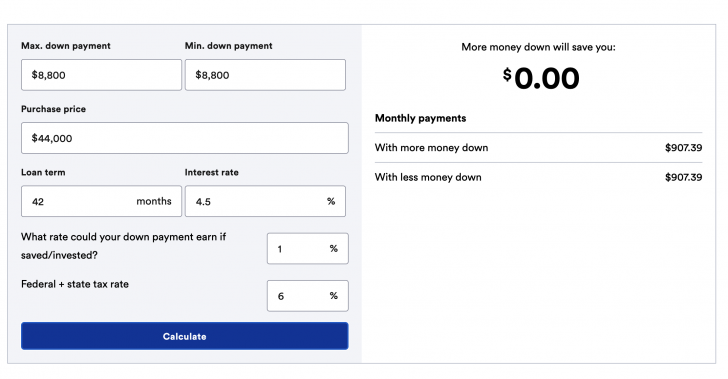

This rule suggests that buyers should put down at least 20% of the vehicle’s price, finance the car for no more than four years, and ensure the monthly payment does not exceed 10% of their gross monthly income. Applying this to the Corvette at its current value means a down payment of approximately $12,840, leading to a monthly payment of around $1,156 over 48 months, assuming an average interest rate of 3.86%.

Opportunity Cost Consideration

Prospective buyers should evaluate the opportunity cost of their investment. For instance, instead of allocating $1,156 monthly towards a car payment, investing that sum in the market with a conservative 6% return could yield significant gains over five to ten years, highlighting the potential benefits of choosing more affordable transportation options and investing the difference.

Personal Rule: Emergency Fund and Investing

A robust financial strategy includes maintaining a six-month emergency fund and investing 15% of gross income into retirement accounts. This approach offers flexibility in spending the remaining income without a specific cap on vehicle expenses, encouraging a balance between saving, investing, and spending based on personal priorities.

Dave Ramsey’s Approach

Dave Ramsey advocates for a vehicle cost not exceeding 50% of the buyer’s annual gross income, emphasizing the advantages of purchasing vehicles in cash to avoid interest payments and lower insurance costs. For a Corvette, this would necessitate an annual income of at least $128,400.

The 1/10th Rule by Financial Samurai

This conservative rule advises that individuals should not spend more than 10% of their gross annual income on the purchase price of a car, advocating for buying used vehicles and holding them for a minimum of five years. This strategy aims to reduce financial stress and increase the ability to invest in appreciating assets.

Our Verdict?

Buying a luxury vehicle like the 2023 Corvette Stingray requires careful financial planning and consideration of various factors, including down payment, financing terms, monthly payments, insurance costs, and the broader impact on one’s financial goals and flexibility. By adhering to these rules and strategies, individuals can make informed decisions that balance the joy of owning a desirable vehicle with the imperative of maintaining financial health and pursuing long-term wealth accumulation.

More inCar Insurance

-

`

How to Safely Drive Away from Wildfires – Essential Tips

Wildfires are unpredictable and dangerous, often spreading rapidly with little warning. A video from the Los Angeles wildfires showed abandoned cars...

February 1, 2025 -

`

Can Your Car Keep You Safe During an Emergency?

Natural disasters such as wildfires, hurricanes, and floods can occur unexpectedly, leaving little time to prepare. In such situations, your car...

January 25, 2025 -

`

Tesla Reveals 2025 Model Y Juniper – Here’s What’s New!

Tesla has revealed the 2025 Model Y Juniper, a refreshed version of its best-selling electric SUV. This update enhances design, comfort,...

January 25, 2025 -

`

How to Check Transmission Fluid for Optimal Car Performance

Maintaining your vehicle’s transmission is just as essential as other routine car maintenance tasks like oil changes or tire rotations. Knowing...

January 18, 2025 -

`

Sutton Foster and Hugh Jackman Spark Romance on L.A. Date Night

Hollywood is abuzz with the latest photographs of Hugh Jackman and Sutton Foster, who appear to be confirming their romance during...

January 16, 2025 -

`

How to Fix Car Window Off-Track and Align It Properly

When your car window gets stuck or misaligned, it’s often due to an off-track issue. Learning how to fix car window...

January 10, 2025 -

`

How to Drive a Stick Shift: A Quick Guide for Manual Beginners

Driving a stick shift requires coordinating the clutch, brake, and accelerator to control a car with a manual transmission. Manual cars...

January 3, 2025 -

`

Why Drowsy Driving Is Just as Dangerous as Drunk Driving

Drowsy driving poses a serious risk to road safety, yet many underestimate its dangers compared to drunk driving. The National Sleep...

December 27, 2024 -

`

Where Is Hyundai Made? A Look Inside Global Manufacturing Hubs

Hyundai vehicles dominate roads worldwide, offering reliability and innovation. Yet, only some people know where these cars are actually made. The...

December 20, 2024

You must be logged in to post a comment Login